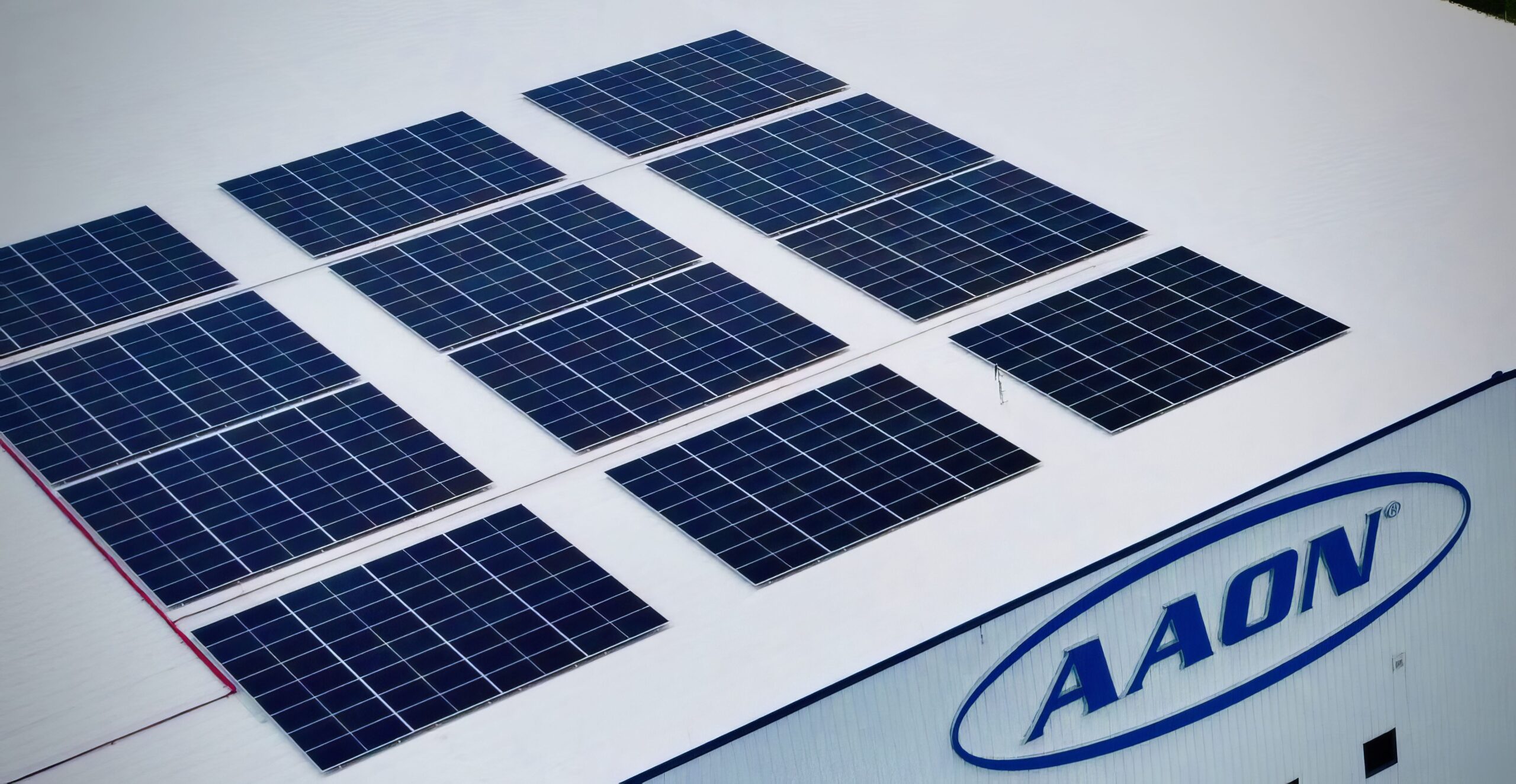

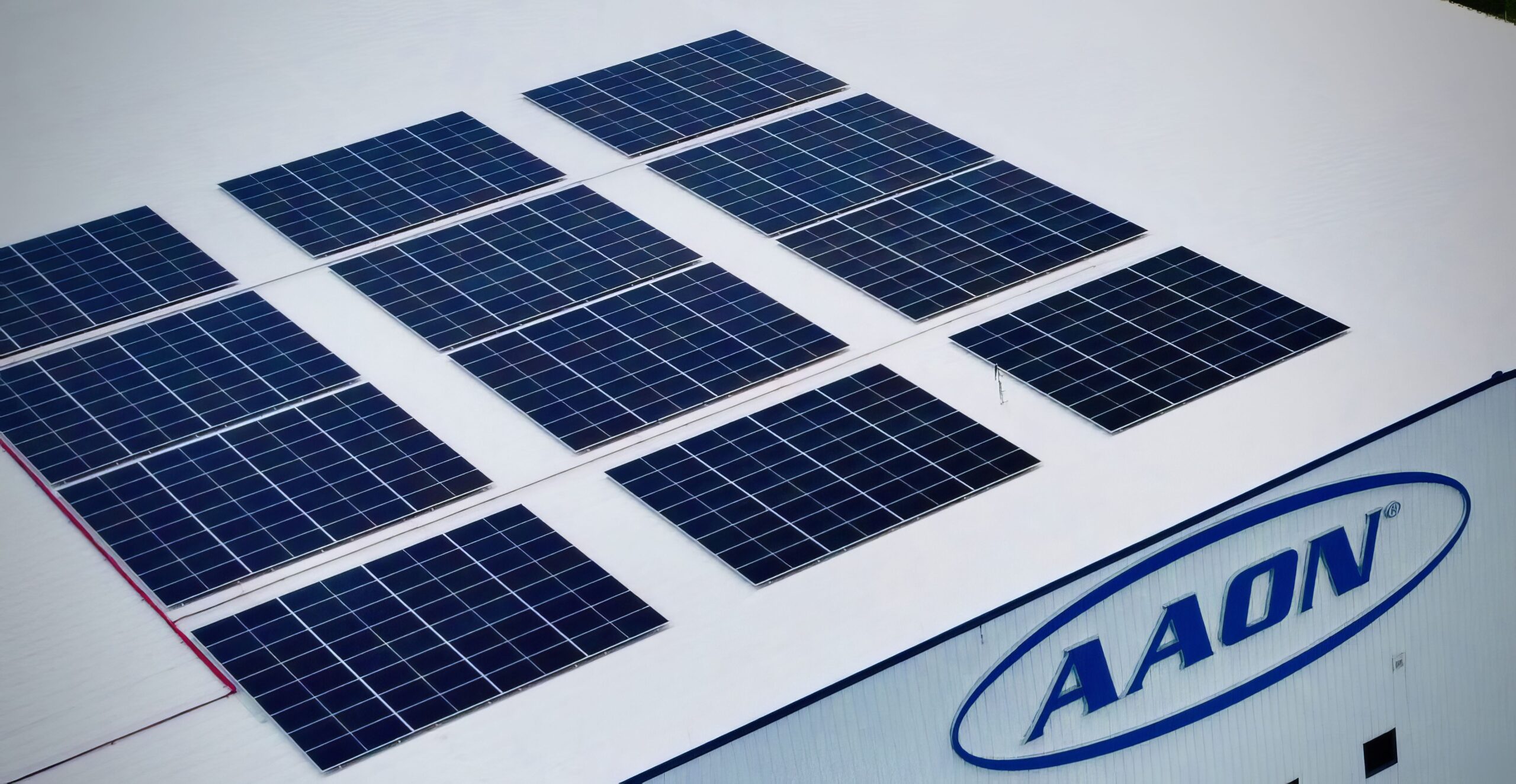

Rooftop Solar

Convert your roof into a valuable asset, and minimize your operating costs

Rooftop Solar

Convert your roof into a valuable asset, and minimize your operating costs

Coverage

Commercial & Industrial

Enhance efficiency with tailored solar solutions. Reduce energy costs and support sustainable growth for commercial and industrial enterprises.

High Output

Powerful Redundancy

Coverage

Commercial & Industrial

Enhance efficiency with tailored solar solutions. Reduce energy costs and support sustainable growth for commercial and industrial enterprises.

High Output

Powerful Redundancy

Financial Resources

Solar Incentives

30% Federal Tax Credit

This credit is slated to last until 2032 and covers all costs associated with a solar and/or battery installation. This credit can be carried over 5 years.

30% Federal Tax Credit for non Taxed Entities

Non-taxable organizations, including tribes and non-profits, can now receive the 30% Federal Tax Credit as Direct Pay under the Inflation Reduction Act.

+10% for Low Income Areas

Eligible areas in low income areas qualify for an added 10% tax credit or Direct Pay. See map in link below

+10% for Tribal Lands

Systems installed on tribal lands qualify for an additional 10% tax credit, available in the form of Direct Pay.

5 Year Accelerated Depreciation

The entire cost of a solar/storage system can be depreciated over 5 years with 50% extra in the first year, equating to ~15% off net present value.

Solar on New Roofs

Bifacial solar panels can be installed on white roofs, qualifying them as solar property and allowing for a larger tax credit.

Learn More

Call or Text

(918) 720-0000