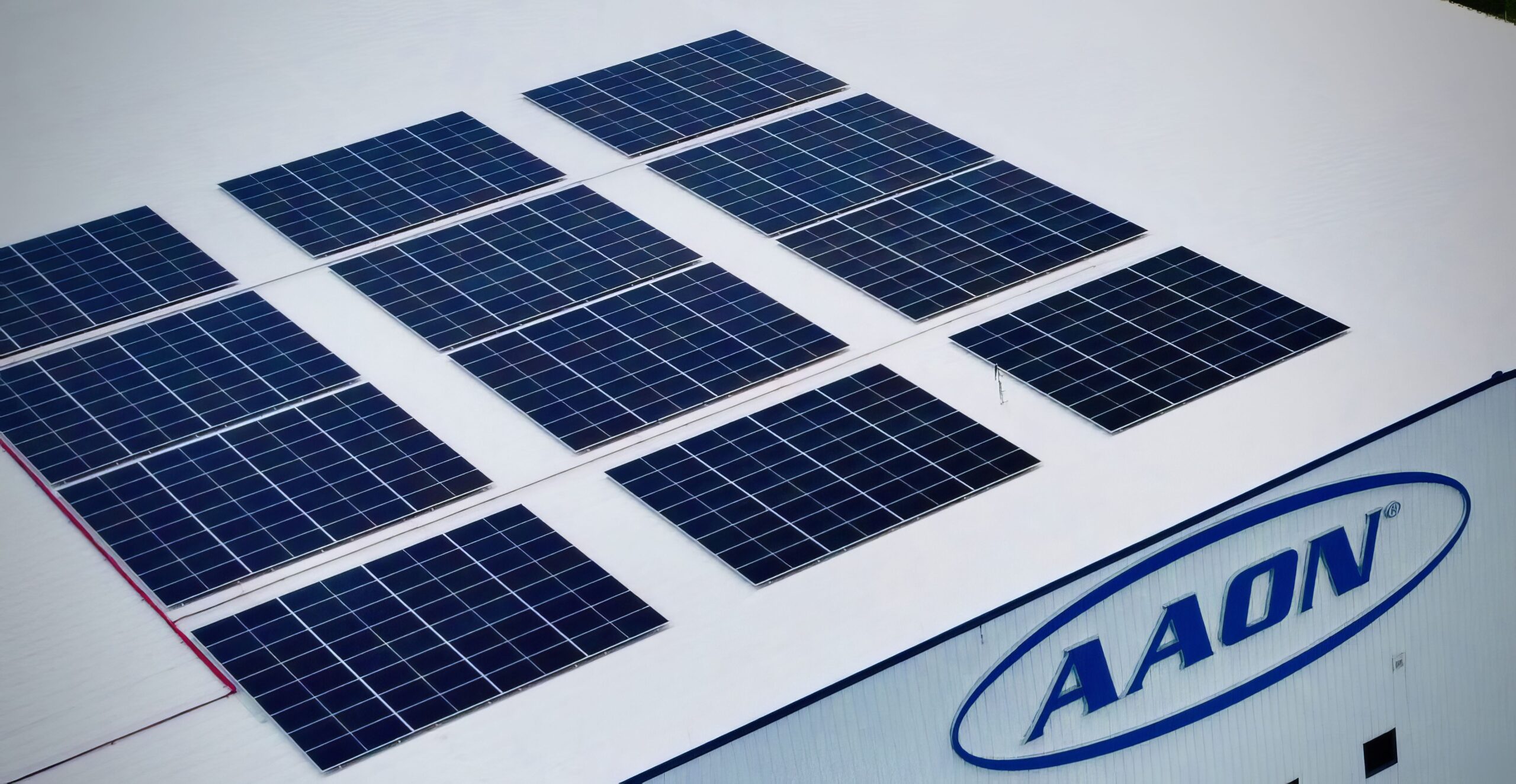

Transform Your Business's Energy and Save up to 95% on Electricity

Unlock substantial savings on your solar installation with a 30% federal tax credit. Over the past decade, solar panel costs have plummeted while efficiency and durability have soared, dramatically improving return on investment. When combined with utility incentives, grants, rebates, and additional state tax benefits, your solar project’s ROI can be truly remarkable.

Solar Incentives

30% Federal Tax Credit

This credit is slated to last until 2032 and covers all costs associated with a solar and/or battery installation. This credit can be carried over 5 years.

30% Federal Tax Credit for non Taxed Entities

Non-taxable organizations, including tribes and non-profits, can now receive the 30% Federal Tax Credit as Direct Pay under the Inflation Reduction Act.

+10% for Low Income Areas

Eligible areas in low income areas qualify for an added 10% tax credit or Direct Pay. See map in link below

+10% for Tribal Lands

Systems installed on tribal lands qualify for an additional 10% tax credit, available in the form of Direct Pay.

5 Year Accelerated Depreciation

The entire cost of a solar/storage system can be depreciated over 5 years with 50% extra in the first year, equating to ~15% off net present value.

Solar on New Roofs

Bifacial solar panels can be installed on white roofs, qualifying them as solar property and allowing for a larger tax credit.

Commercial Projects

NABCEP Certified

PV Installer

Licensed and Insured

Systems Engineered

For A 25 Year Life Cycle

Expert Service In The

Unlikely Event Of An Issue

Over 3 Megawatts

Of Solar Installed